inherited annuity tax rate

Income payments from your annuity are evenly divided by the principal amount and its tax exclusions over the expected number of payments. Here you would sell a period of the annuity disbursement or a portion of each payment.

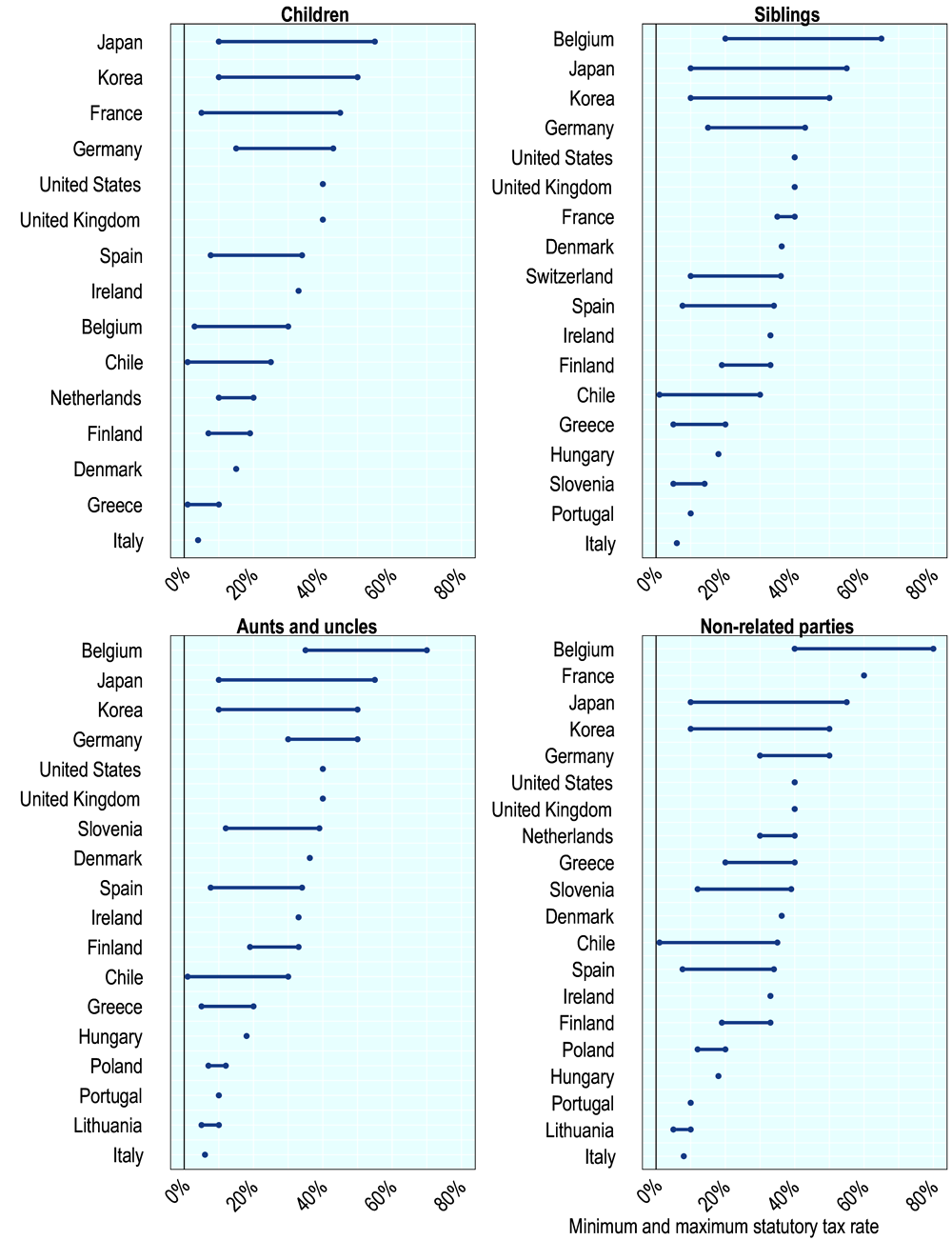

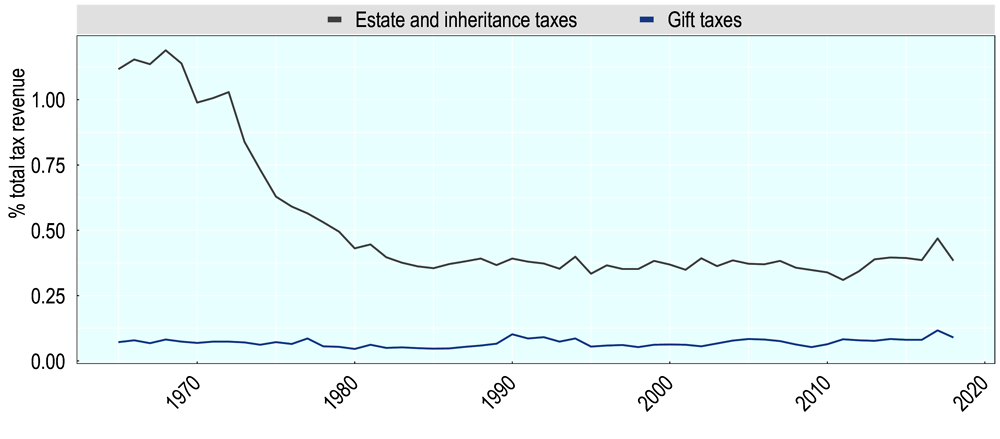

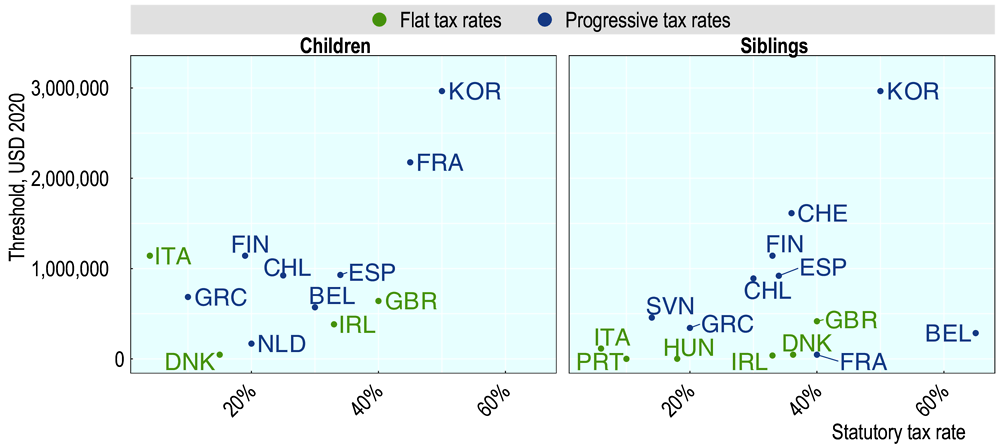

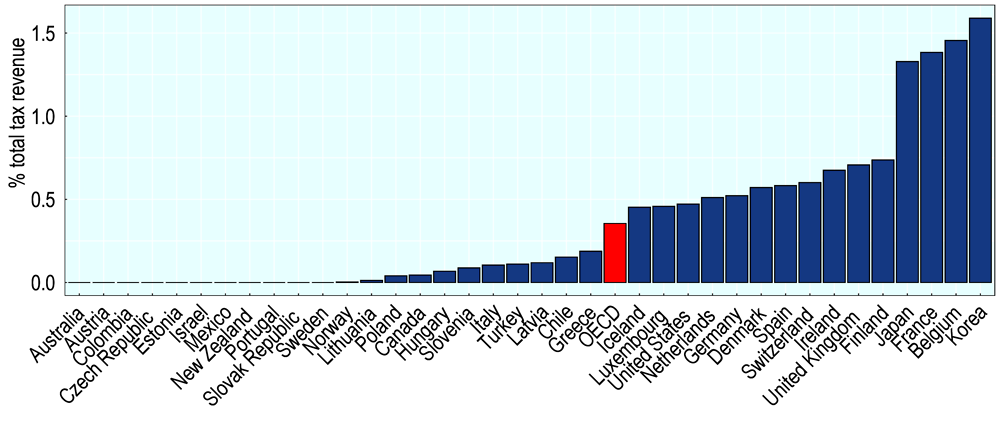

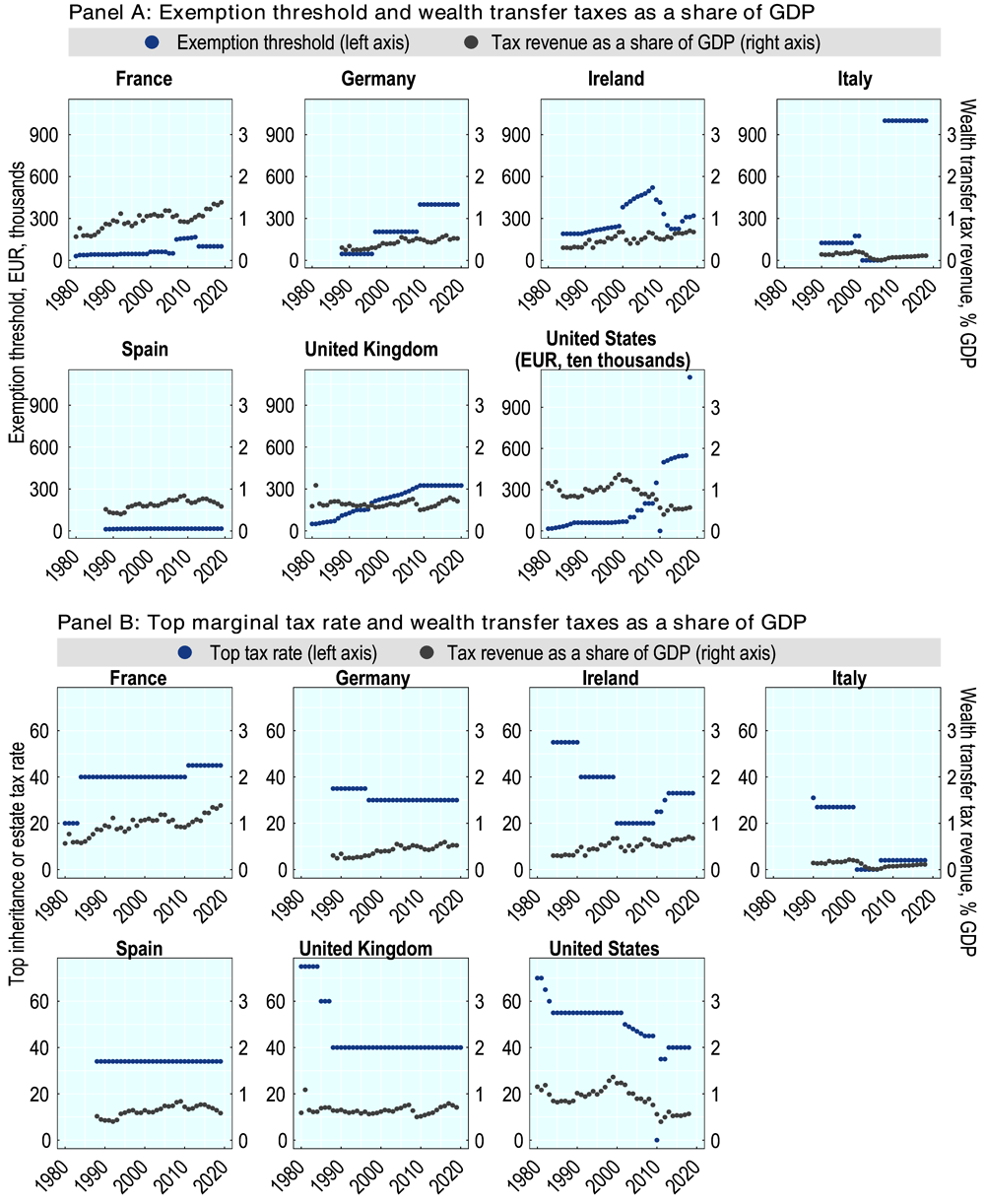

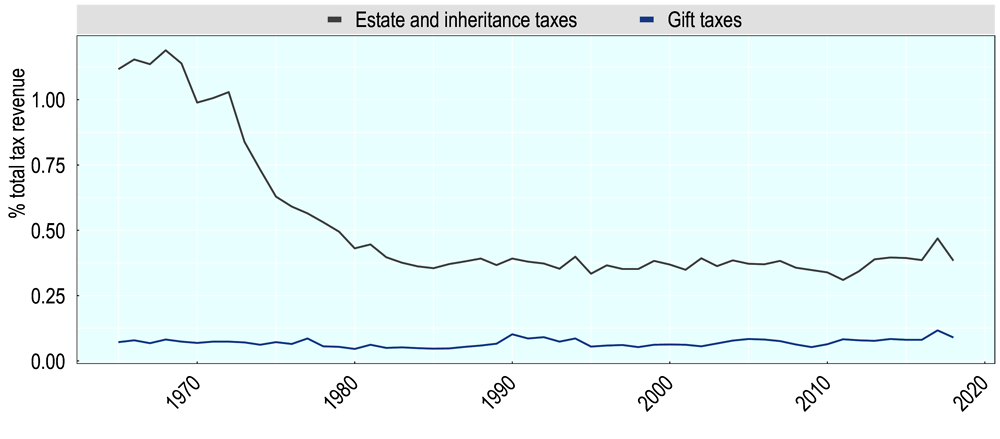

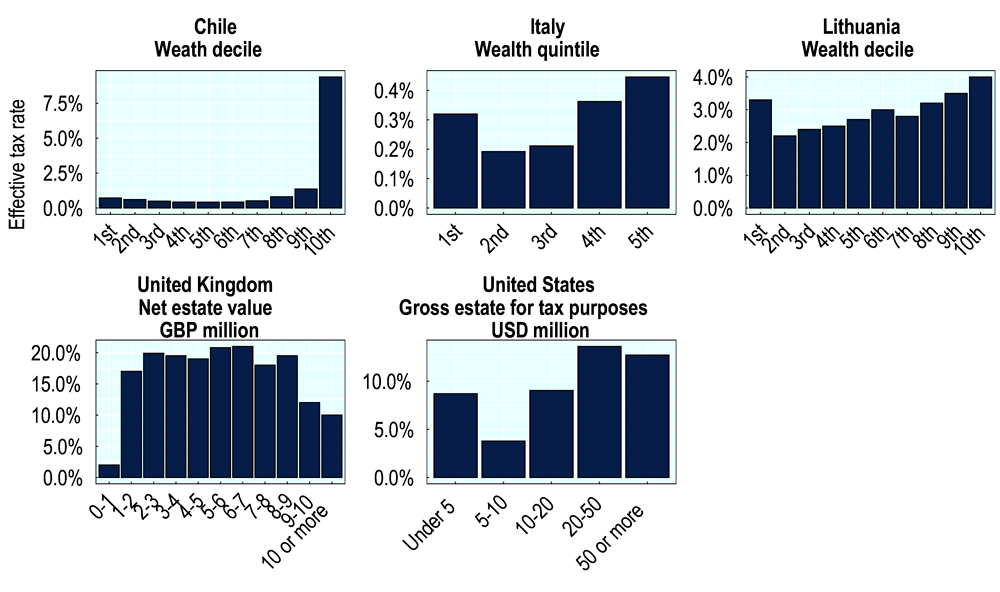

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax.

. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. For example if your father put 250000 into the annuity you will not owe taxes on that amount when receiving the lump sum payment but if the annuity has earned 50000 in interest you will owe taxes on the. Most likely the entire amount of any tax-sheltered annuity TSA you inherit will be taxable.

The earnings come out and are taxed first and the basis comes out after the earnings are exhausted. Tax Rate on an Inherited Annuity. Taxes are due once money is withdrawn from the annuity.

Surviving spouses can change the original contract into their own name. All 20000 withdrawn from the annuity will appear on your tax return as ordinary income. The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket.

Taxes are due once money is withdrawn from the annuity. If you keep the annuity you will usually have to start taking withdrawals from it. Withdrawing money from your annuity before turning 59 ½ years old will result in a 10 early withdrawal penalty in most cases.

Immediate annuities typically have a 10 early. Inheriting a TSA. The earnings are taxable over the life of the payments.

These annuity payments are taxed at your regular tax rate and can be sold wholly or in part for cash-in-hand. This allows partners to enjoy the same. Penalties for cashing out an inherited annuity depend on the type of annuity and the beneficiarys age.

In turn taxation of. If the annuity owner still had ownership when he died the value of the annuity is. You actually have two options if you decide to part with the inherited annuity.

Lump-sum distributions withdrawals from non-qualified annuities are broken down into basis and earnings. Different tax consequences exist for spouse versus non-spouse beneficiaries. If youre not the spouse of the deceased you basically have two options for taking distributions.

Estimating what you might owe in taxes can help you decide which payout option makes the most sense. Generally the best way for. You can take the entire value of the annuity as a lump sum or set up an inherited IRA to receive the money.

Although you will not owe taxes on the principal or the amount your father paid into the annuity you will owe taxes on the interest the premium has earned. Federal tax law only imposes an estate tax on wealth passed down at death. When you inherit an annuity the tax rules are similar to everything described above.

The insurance company. So if you have an annuity that promises payments for the next 10 years you could sell five years of these payments. A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account.

So the tax rate on an inherited annuity is your regular income tax rate. One drawback is that a spouse who takes over a deceased spouses annuity would then be subject to the 10 percent early distribution penalty if she needed to. The first is a partial sale.

Inherited Annuity ddemarino The federal tax on the distribution would be at her marginal tax rate which could be 10 12 22 24 or. Qualified annuity distributions are fully taxable. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account balance.

At that point you have a 180000 account of. Annuity Taxes for Surviving Spouses. Either way you will pay regular taxes only on the interest not the principle.

Inherited annuities are considered to be taxable income for the beneficiary. Just like any other qualified account such as a 401k or an individual retirement account the full value of a qualified annuity which was purchased with funds on which taxes were deferred will be subject to income tax. If you expect to inherit an annuity its important to consider beforehand how that might affect your tax situation.

An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. Tax Consequences of Inherited Annuities. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death.

The tax rate on an inherited annuity is determined by the tax rate of the person who inherits it. Inherited Annuity Tax Implications. So the tax rate on an inherited annuity is your regular income tax rate.

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. How taxes are paid on an inherited annuity will depend on the payout structure selected and the. How Inherited Annuities Are Taxed.

Once the annuity enters the annuitization phase they must begin paying taxes on earnings as well as any other untaxed portions. Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities. Annuity Taxes for Surviving Spouses.

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira

End Of Year Contribution And Distribution Planning For Tax Favored Accounts Https Www Kitces Com Blog End Of Year Contribution Di End Of Year How To Plan Ira

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

South Carolina Estate Tax Everything You Need To Know Smartasset

How Are Inherited Annuities Taxed Annuity Com

Inherited Annuity Tax Guide For Beneficiaries

Inheritance Tax Guide Octopus Investments

Succession Planning Archives The Spectrum Ifa Group

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Phil Wasserman Roth White Paper Roth White Paper Cool Photos

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary